Banco Central: Economic Forecast Monitor (October 2016)

Today the Centrale Bank van Aruba (CBA) publishes an update of the Economic Forecast Monitor (EFM) on its website [ed.: see complete EFM at the end of this article]. The EFM provides an overview of both local and global economic forecasts by different institutions. This update also includes the revised local forecasts earlier published in the CBA’s Economic Outlook. A summary of the forecasts is discussed below.

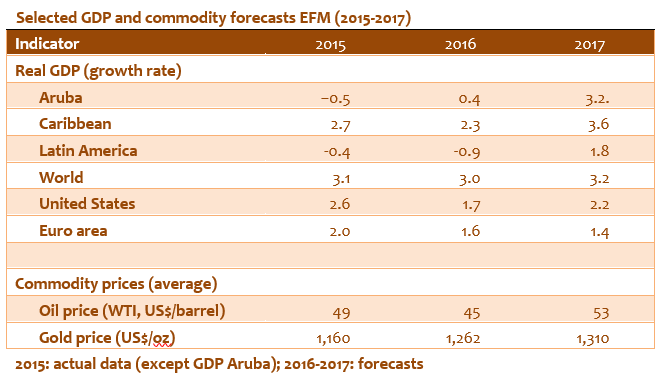

The Aruban economy is projected to expand (in real terms) by 0.4 percent in 2016, provided that the investment activities with respect to the restart and upgrading of the oil refinery get underway. The effects hereof will be substantially larger in subsequent years as additional investments are assumed for the period of 2018 onwards, during which time the oil refinery is expected to become fully operational. Preliminary estimates of the CBA indicate a real GDP-growth rate of 3.2 percent for 2017.

The current forecasting trend shows that international financial institutions have become slightly more pessimistic as the GDP-forecasts for 2016 of the industrialized countries were adjusted downwards, lingering beneath the 2.0 percent growth level. The outlook for 2017 is slightly more positive for the United States and Canada. The view on Europe, in particular Great Britain, is heavily influenced by the Brexit-vote last June and the plunge of the British pound. The forecasters also downgraded the 2016 growth levels of Latin America, with the notable exception of Peru. A more positive development in these countries is, however, anticipated in 2017, although the economic crisis in Venezuela will remains in effect. The only large countries with expected and continuing significant GDP-growth levels are China and India.

Projected inflation levels in advanced economies were also revised downwards and, therefore, expected to remain at low levels in 2016. In the Latin American economies, inflation is expected to pick up again, especially in Argentina, Brazil, and Venezuela.

Oil prices are forecasted to increase somewhat towards the end of 2016, i.e., to US$ 51 per barrel. For next year, there is consensus that the oil prices will rise further. In addition, the price of gold is expected to increase somewhat in the coming period.

Expresionnan haci den e articulo aki no necesariamente ta refleha opinion di ArenaPoliti.co